When you’re buying a property, Stamp Duty can be a significant expense that you need to consider. So, read on to find out when the tax is paid and how to calculate a potential bill.

According to data published in IFA Magazine in June 2025, the government collected £14.1 billion in Stamp Duty in the 12 months to the end of May 2025. The figure is a 20% increase when compared to the same period a year earlier.

With the threshold for paying Stamp Duty halving on 1 April 2025, very few properties will be exempt from the tax, so the amount could increase even further in the coming year.

Please note, Stamp Duty is paid in England and Northern Ireland. There are similar taxes in Scotland and Wales, known as “Land and Buildings Transaction Tax” and “Land Transaction Tax” respectively, which have different thresholds, rates, and reliefs.

Stamp Duty is paid when you purchase a property or land

Stamp Duty is a type of tax you may pay when purchasing a property or land in England and Northern Ireland if it’s worth more than £125,000.

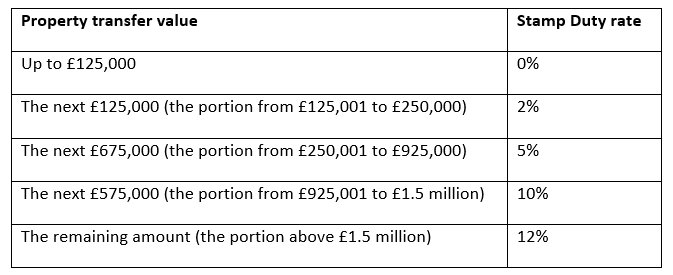

The rate of tax you pay will depend on which band the portion of the property’s value falls into. So, you could pay Stamp Duty at several different rates.

In 2025/26, the Stamp Duty rates are:

For example, if you’re buying a £600,000 property that will be your main home, and you don’t qualify for any reliefs, your Stamp Duty bill would be £20,000. This would be made up of:

- No tax is due on the first £125,000

- A tax rate of 2% is applied to the portion between £125,001 and £250,000, resulting in £2,500 being due in Stamp Duty

- A tax rate of 5% is applied to the portion from £250,001 to £600,000, resulting in £17,500 being due in Stamp Duty.

The government’s Stamp Duty Land Tax calculator could help you calculate your expected bill.

First-time buyers benefit from a relief

If you’re a first-time buyer, you may be eligible for tax relief.

You won’t need to pay Stamp Duty on property purchases of less than £300,000. For properties costing up to £500,000, you will pay no Stamp Duty on the first £300,000 and benefit from a lower Stamp Duty rate of 5% for the remaining amount.

However, if the property you’re buying is worth over £500,000, you won’t benefit from first-time buyers’ relief and will pay Stamp Duty at the usual rate.

You are considered a first-time buyer if you’re purchasing your only or main residence and have never owned a freehold or have taken a leasehold interest in a residential property. This includes properties abroad and those you may have inherited.

There is a 5% Stamp Duty surcharge on second properties

If the property you’re buying won’t be your main home and it’s worth more than £40,000, you’ll usually need to pay Stamp Duty at a rate that is 5% higher than the standard rates.

This applies to most second properties, such as a buy-to-let investment or holiday home. So, it’s important to include this in your calculations when weighing up if a property is right for you.

Stamp Duty must be paid within 14 days of completion

Even if you don’t need to pay Stamp Duty, you still need to submit a Stamp Duty return. Usually, your solicitor will do this on your behalf, although you can do it yourself if you prefer.

The return must be submitted and Stamp Duty paid within 14 days of completing the sale of the property; otherwise you may face a penalty.

Contact us to talk about your mortgage needs

If you’re buying property using a mortgage, we could help you find the right lender for you. Please get in touch to talk about your needs and how we could offer support that might save you money.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Approver Quilter Financial Services Limited & Quilter Mortgage Planning Limited. 08/07/2025